Deferred compensation calculator

This calculator uses your personal information to develop a custom savings forecast that takes into consideration pension social security the deferred compensation plan and other savings. Nonqualified Deferred Compensation Planner.

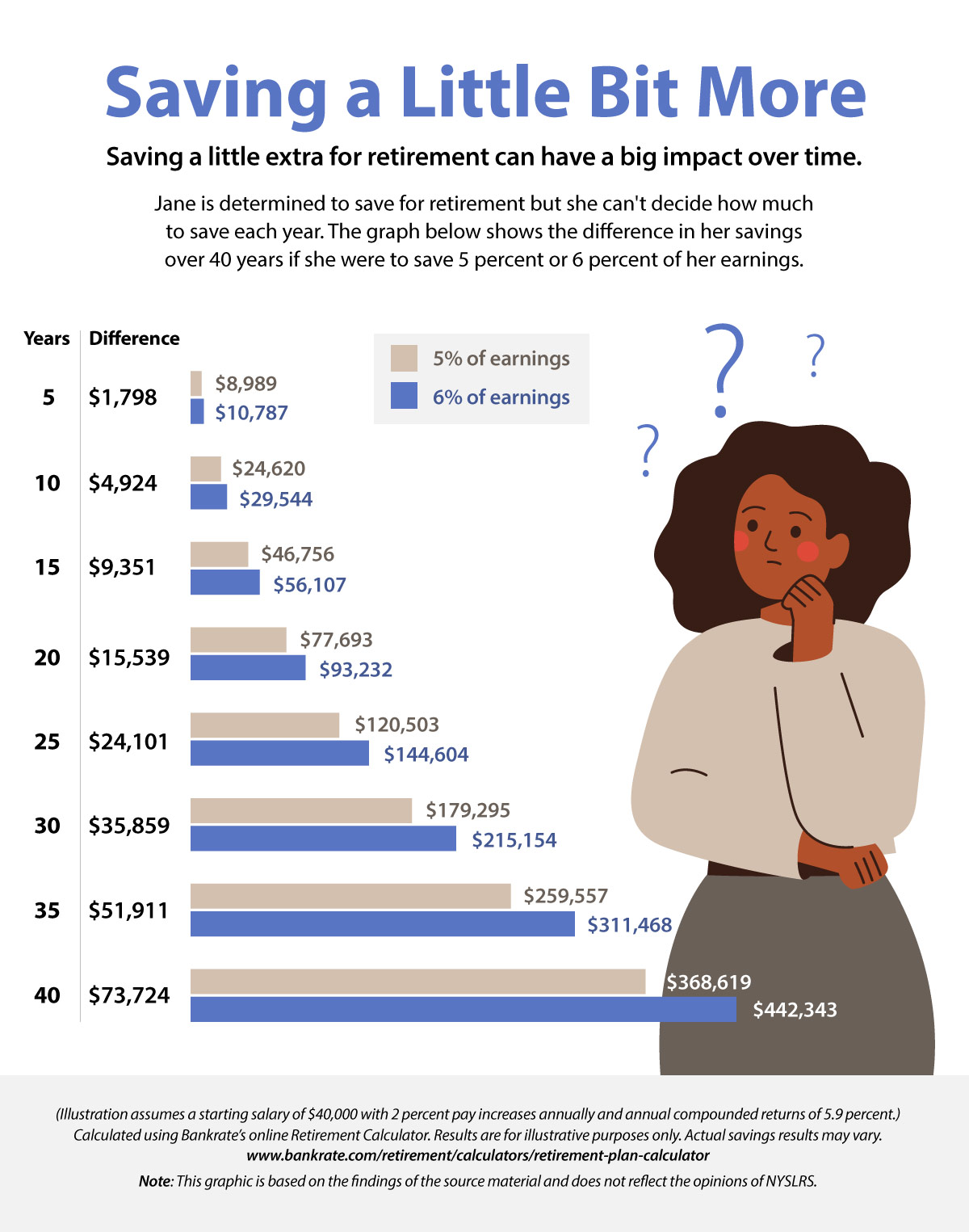

Give Your Retirement Savings A Boost New York Retirement News

A portion of an employees compensation that is set aside to be paid at a later date.

. Youre eligible for retirement. This calculator will help you determine your basic salary deferral limit which for 2022 is the lesser of 20500 or 100 of includible compensation reduced by any of the factors indicated. How long will my money last.

Free Calculator to Help Compare Taxable Investment to 2 Common Tax Advantaged Situations. Build Your Future With A Firm That Has 85 Years Of Investing Experience. ICB Solutions a division of Neighbors Bank.

Get contact information for your financial guidance professionals and plan administrators. The New York State Deferred Compensation Plan is a State-sponsored employee benefit for State employees and employees of participating employers. Here are some tools and calculators that may help you get a better idea about what you will need.

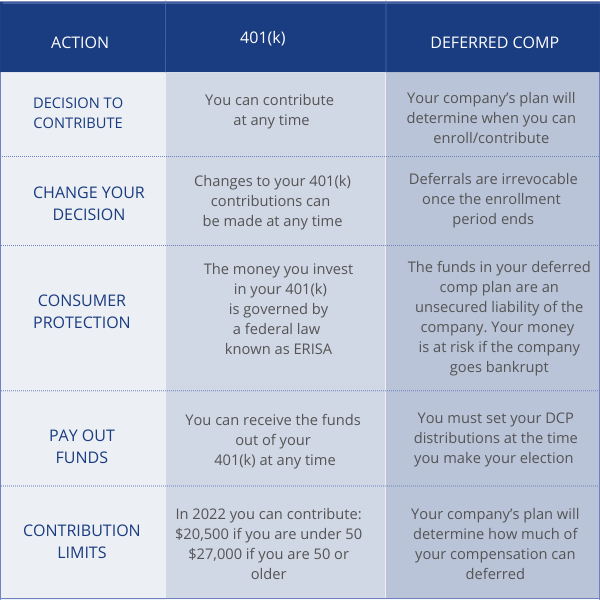

You are using an outdated or unsupported browser that will prevent you from accessing and navigating all of the features of our. How much can I withdraw. Qualified deferred compensation plans 401 ks profit-sharing plans incentive stock options pensions are protected by the Employee Retirement Income Security Act of.

Use this calculator to learn more about the Roth option and decide which is best for your situation - pre-tax or after-tax savings. Our Resources Can Help You Decide Between Taxable Vs. Thats why one common strategy is to use a deferred comp plan as a bridge in retirement income.

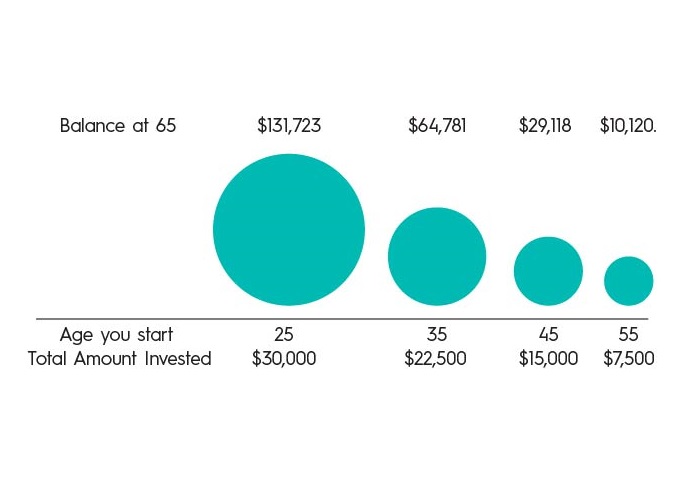

How much can I save. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. ORS does the heavy lifting.

The New York State Deferred Compensation Plan is a State-sponsored employee benefit for State employees and employees of participating employers. Retirement Withdrawal Calculator Use this calculator to help you. Compare an after-tax Roth savings option with a traditional pre-tax retirement savings plan.

Outdated or Unsupported Browser. The Deferred Compensation Option is a competitive easy-to-manage benefit you can offer your employees at no additional cost to your schools. Ad Calculate and Compare a Normal Taxable Investment to Two Common Tax Advantaged Situations.

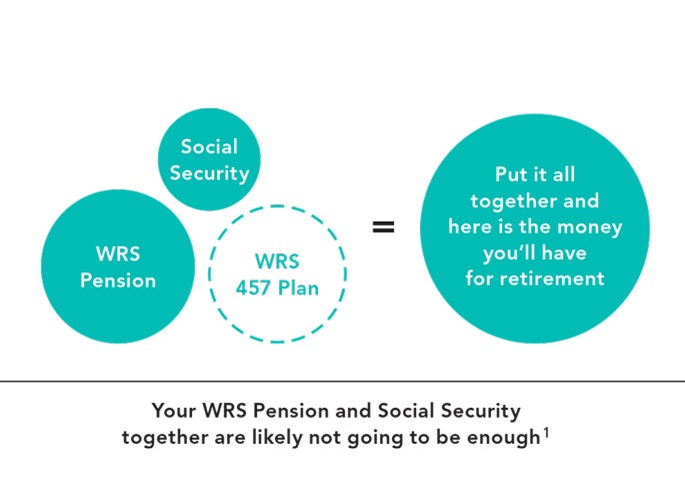

In most cases taxes on this income are deferred until it is paid. The purpose of the 457 Savings Calculator is to illustrate how the 457 can help you save for your retirement. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

Once youve logged in to your account you will find even more tools that can help you. This calculator was created by Charles Schwab Inc for private sector 401k. First all contributions and earnings to your 457.

It can fill the gap between income earned. The Deferred Compensation Program has these calculators available. It provides you with two important advantages.

A 457 can be one of your best tools for creating a secure retirement. Select your monthly DCP contribution. Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk.

Alameda County Deferred Compensation Plan Plan Resources Quick Actions. You will not be. Ad Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement.

DCP savings calculator DCP retirement planner Plan 3 members Retirement Benefits.

:max_bytes(150000):strip_icc():gifv()/TermDefinitions_DeferredTax_V1-7bcdb89b942c43268debeb7043178732.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

Deferred Compensation Plan

457 Deferred Compensation Plan

What Is A Deferred Compensation Plan Ramseysolutions Com

457 Deferred Compensation Plan

Advantages Of Being Self Employed Independent Contractor Infographic Medicaldevices Consultants Sel Medical Sales Medical Sales Rep Pharmaceutical Sales

:max_bytes(150000):strip_icc():gifv()/Deferredtaxliability_fial_rev-aa7da3f65e644dfea5b55f8ca59f54e4.png)

Deferred Tax Liability Definition How It Works With Examples

Ibm Tdsp Calculator Ibm Calculator How To Plan

Flood Projects For School Flood Insurance Flood Damage Home Insurance

Nonqualified Deferred Compensation Planner

Deferred Compensation Plan

/TermDefinitions_DeferredTax_V1-7bcdb89b942c43268debeb7043178732.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

2

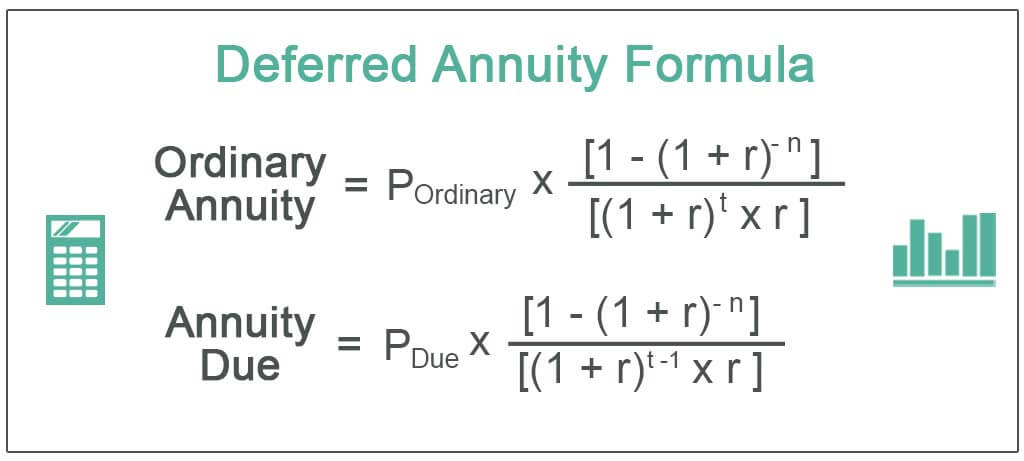

Deferred Annuity Formula How To Calculate Pv Of Deferred Annuity

How Do Deferred Compensation Plans Work Avier Wealth Advisors

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

Deferred Compensation Not Income For Child Support